Using status as a customer acquisition message

Scarcity sells

Mehdeeka covers B2B, SaaS, and startup/tech marketing. Check out the previous issue; comparing what neobank customers said against the same banks’ Facebook ads. Help me grow Mehdeeka by sharing it with a friend or colleague!

Wow, who knew I would be back with a fifth issue on fintech? I am keen to move on from the topic, but couldn’t resist one more issue as Stacy Goh from Outwrite emailed me after last week’s issue with her own experience of being a neobank marketer and testing a lot of customer acquisition messaging.

By the way, this isn’t the first time Stacy has been on Mehdeeka - check out my interview with her on Outwrite’s rebrand here!

The summary for last week’s issue is really “and the card is pretty lol” which is a direct quote from an Up Bank customer as one of the reasons they picked Up as a financial services provider. And Up isn’t the only bank that has used unique card designs to sell bank accounts. I’ll get into more details later, but first here’s what Stacy emailed me about.

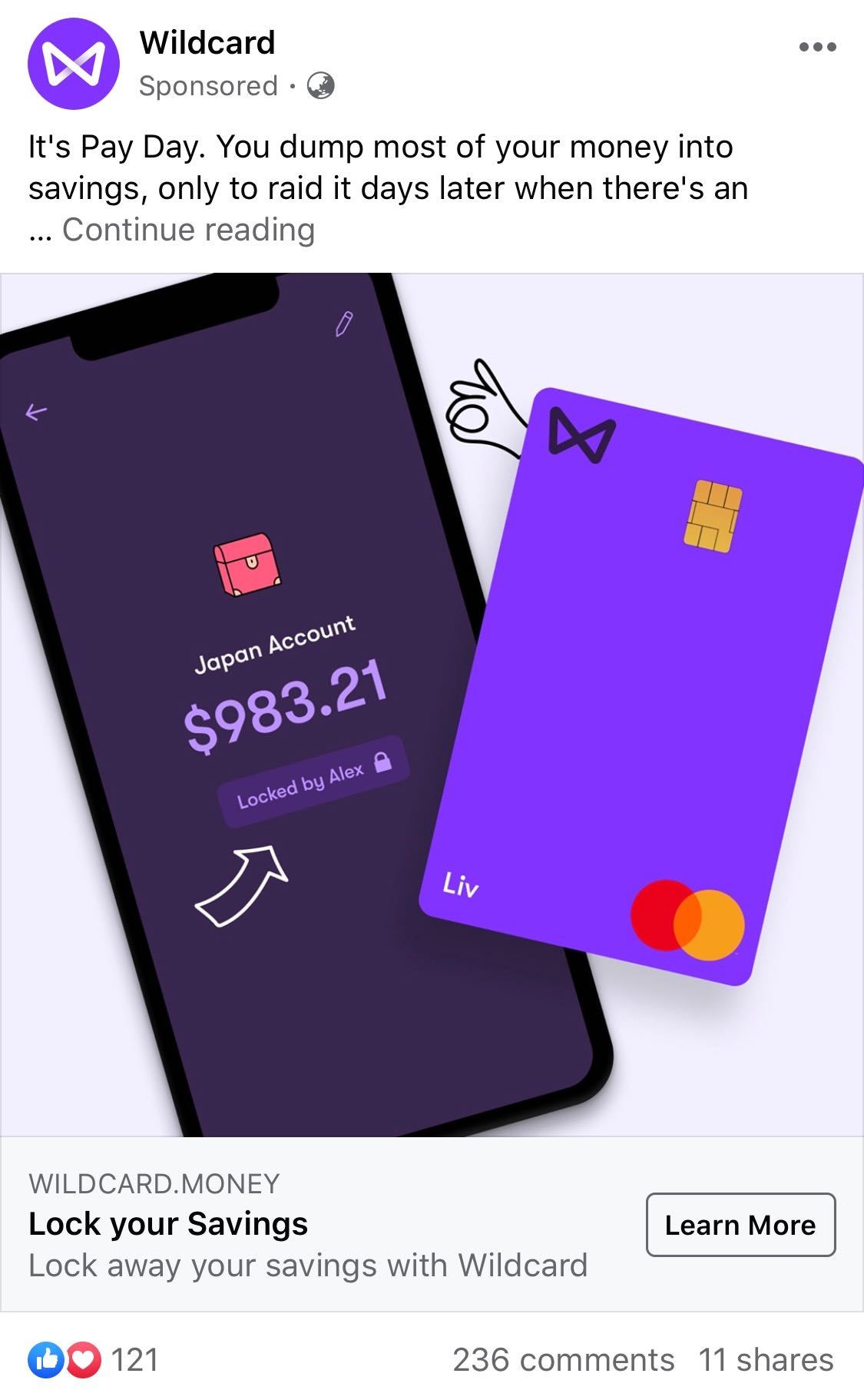

Stacy previously worked for Wildcard, which was a banking service with a purple card design. Stacy said there were three themes that emerged in her testing;

"Be the first". Pre-launch, our most successful ad was "Be the first to get a purple card", with an illustration of the card. Nothing else. Our landing page just had a text field to submit your phone number, with no details about features. That was enough to build up a decent waiting list.

"Their card is really pretty lol". I can relate to Up Bank on this point. Our most successful image was a photo of our card tapping a Square terminal that we took on an iPhone. People really digged the purple + vertical card aesthetic, and the fact that they could customise their name on the front.

Storytelling. As you'll see from the images, each of my later ads told a story about where the reader is now (eating cereal for dinner), and where they could be with Wildcard (having money leftover at the end of their pay cycle). This was based on a story one of our early customers told us. I specifically wrote messaging about short-term, specific goals rather than the vague "be financially free" ads that most big banks seem to use. People definitely connected with that - we gained hundreds of comments like "I need this".

I don't think I made a single ad that mentioned interest rates, fees, or Apple Pay. Instead, I focused on what made us different, and what would ultimately be more effective at helping you save more money — stretching out your pay cheque, and locking away savings.

And here are the ads!

I don’t want this whole issue to be about fintech and I think the concept of driving scarcity is interesting enough to hold a long conversation on.

First of all, it’s not a new concept. The status that comes with premium credit cards - a la the Amex black card (real name: Centurion card), an invite only credit card with a $5,000 annual fee first introduced in 1999 - is founded in being part of an elite club based on wealth.

Well we all know a lot of startups are just bringing old, elite concepts to the masses, and that’s basically what these neobanks are doing with their cards. Square has a personalisable card (you can submit a basic line drawing for the corner of the card), Revolut has a smorgasboard of card designs to choose from, and I found out that there’s even r/revolut on Reddit, and this was (and this is not a joke), the top post when I visited:

Here’s the thread if you’re interested in reading it. Revolut also offer a metal card that costs $30/month, and if you lose it a replacement is $80. And let’s not forget the Apple credit card.

The big banks have done this too. Bankwest allows you to choose the colour of your card when you sign up, and ANZ allows you to upload images that take up the entire face of the card.

As Stacy said above, one of the key motivators she found to work was “be the first” to get an exclusive card. But what happens when that scarcity runs out? What happens when everyone has a cool card? What about when everyone has switched to Apple Pay and GPay and cards are obsolete? I guess that’s why Revolut has built a community around owning and collecting multiple cards. I’m sure we’ll see Up Bank follow that path.

*side note, the idea for the Amex black card, according to Doug Smith, a European director, was based on "rumors going around that we had this ultra-exclusive black card for elite customers. It wasn't true, but we decided to capitalize on the idea anyway.” So financial prestige and gossip go hand in hand.

You heard it here first - links

Status symbols aren’t exclusive to financial services. The one and surprisingly only link I have this week is an article titled Whats The Next Status Chocolate?

It’s actually not that great of an article and is more a list of chocolate brands we can’t get here in Australia, but it goes great with this week’s theme.

I think it’s interesting that a lot of the ‘why’ these chocolate brands are popular is because they’re eye catching. You see it in a store, you want it, and then you want everyone to see you with it.

It can be really hard when seeing marketing examples and thinking “that’s great but how do I apply it to my niche SaaS market”, but status and scarcity can be applied to anything. Salesforce famously have their rare stickers that are created for very specific events and never handed out anywhere else.

Events are also an easy way to create scarcity (although $$$). A roundtable breakfast event for your highest ACV customers, plastered over social media, exclusive content that only gets sent out in your newsletter. If it’s built into your product, that’s even better.

I think one of the best ways to find out what your scarcity selling point is, is to really listen to what your current customers love about you that they can’t get from anywhere else.

At Perkbox (disclaimer: my day job), when I run case study interviews my final question is always “is there anything you want to mention that we haven’t spoken about yet” and the answer is always either a) the monthly resources we send are invaluable to their HR team or b) they want to shout out their Customer Success Manager for being incredible. As a result, this has become something I’m working on creating more of a value proposition around for the sales team to use in the pitching process.

Find yours!