He said, she said: Customer acquisition

Comparing fintech facebook ads to what their customers say

Mehdeeka covers B2B, SaaS, and startup/tech marketing. Check out the previous issue; an interview with Anhar from Wise. Help me grow Mehdeeka by sharing it with a friend or colleague!

*Pre-warning that this is a very long version of Mehdeeka*

Usually my mini-topics span only three issues, but I had an extra idea on FinTech so it’s back for an extra week! Basically, I wanted to ask “why do people choose your fintech service over your competitors?” I did ask this to Alex from Hay, answer below;

K: If there's one thing consumers care the most about when comparing the neobanks, what do you think they're comparing them on? Is it design and brand, or features and interest rates, or something else?!

A: The relationship Australian consumers have with their financial products is quite fragmented. They are willing to have their salary, savings, credit cards and personal loans all with separate providers to best suit their needs. For transaction accounts, consumers are looking for improved practicality. We believe it to be a balance of automation and autonomy. They want the complex elements of financial management like monthly budgets automated, while giving them the flexibility convenience and control to spend and send their money in a variety of ways that suits them at a particular moment.

And this issue is an expansion on that! I figured one way to go about it is to look at Facebook ads (classic) vs some responses to my question in a Facebook group for listeners to the Aussie financial podcast, She’s On The Money.

This is a great place for me to do my usual segue into ‘this newsletter is free but not cheap’ - this is one of the more strenuous issues too. If you feel like this newsletter brings you something you enjoy or learn from, please consider sending me spare change on Buy Me A Coffee, or use the same link to sign up & I’ll earn a referral.

Up is definitely the most popular bank in the podcast group, and 11 out of 17 of the responses I got were from people who use it.

Here are the pro-Up comments;

I use up for my everyday and a few of my savings! I love the visual component, as well as all the easy to use features! Customer service is amazing -never had to wait more than a few minutes for a reply.

I opened an up Account the other day. My bills, food and petrol are in the credit union, but up I can split my savings across a whole range of goals. What drew me in though when traveling internationally it’s free free to use my card. So that’s a massive win. Plus I can see all my goals on the one page and not have many accounts. Since having up I have closed 3 bank accounts

I recently just moved from commbank to UP and I have zero complaints. The customer service is awesome, they’re ethical, there’s so many great features in their app and they have a roadmap which shows what features are in the works or coming soon. Also their card is really pretty lol

Some have Up as well as other banks;

I have Up and ING and I just find ING easier to use plus they rebate your fees from bank machines if you withdraw cash...which is rare these days due to pay wave. Also most banks have pay ID now including ING and Up.

I use Up for my everyday and smaller savings, Commbank for my bills. Lastly my house deposit and holiday savings with Westpac for the 3% interest. I just prefer to have seperate banks for my things as it suits my savings goals and it helps me budget as I know I am covered for all bills to come out without me accidentally spending them!

And of the few who had gotten an account with Up and then closed it…

I was using up for my everyday and savings. But if you plan on using your savings to put towards a house or a loan be mindful that they won’t come up as separate accounts. Very frustrating when needing to supply bank statements. I’ve moved back to my old bank because of this. Plus the interest isn’t good anymore.

Even people who didn’t have Up still seemed quite educated about them;

I moved to 86400 recently, mostly because they don't have any minimum spend to gain their bonus interest rate. You can't have as many savings accounts as you can with Up (you can only open 3 savings accounts, unless you want to add some shared accounts), but the interest is slightly better at the moment.

And finally, the answers that were not about Up at all;

Bank Australia- ethical

Bendigo Bank, I live in a rural area & all of our banking goes toward community funds of improving our local community. It’s a fantastic model. They have low fees & fantastic products. And they know our names when we need to go in to the branch.

I like MEBank. Very helpful customer service, good interest rate, and no atm fees even for private atms.

Bank Australia - Swapped from Westpac and went with BA as I liked the ethical banking approach.

Here’s what I found interesting about the ads

Not one of Up’s Facebook ads address any of the points made in the comments, and only one ad went to a landing page with more information about Up - the rest all went to app stores/app installations. I really want to know who is installing banking apps before they have accounts? I don’t know, is this where I find out I’m out of touch with the world? Don’t get me wrong, I am with BankWest which is 100% online and I signed up online ~before online banking was cool~ but I still checked out all the info about opening an account before I installed the app?

Up’s ads focus on the $5 you get when you sign up, being “easy” (and here is where I ask, is using the phrase “easy money” with a financial service ethical? Is that actually allowed?), having the highest ranked banking app, and “get what you want in life”.

Here’s the first and largest block of info from the landing page;

It does really focus on the multiple savings accounts and goals, which echoes most strongly what was said in the Facebook comments. The rest of the landing page has more information, but even this is the third ‘block’ on the page which is quite far down in my opinion. Obviously it’s working for them when they have die hard stans though!

The other banks

The next bank mentioned is 86 400, and their ads align more closely with what the Up customers were saying;

They actually have quite a lot of ad variants so they’re obviously testing a lot - but these three are the most recent so I wonder if they’ve been reading She’s On The Money comments too… I’d love to know how they’re performing! It’s also interesting that they offer $10 on sign up, double what Up is, but have less stans.

ING are doing purely brand focuses ads, and interestingly ALL of them are for credit cards, not everyday accounts. ING is famously recommended by the Barefoot Investor, and they’ve been around forever and it’s the unique mix of social clout and a firm foundation that makes them an often used/recommended bank.

Next up is Commbank, who just came out with a buy-now-pay-later offering, yet they’re using ‘request a callback’ as a CTA… Oh dear. The other two ads seem to be focusing on the Up customer points though, managing bills and savings.

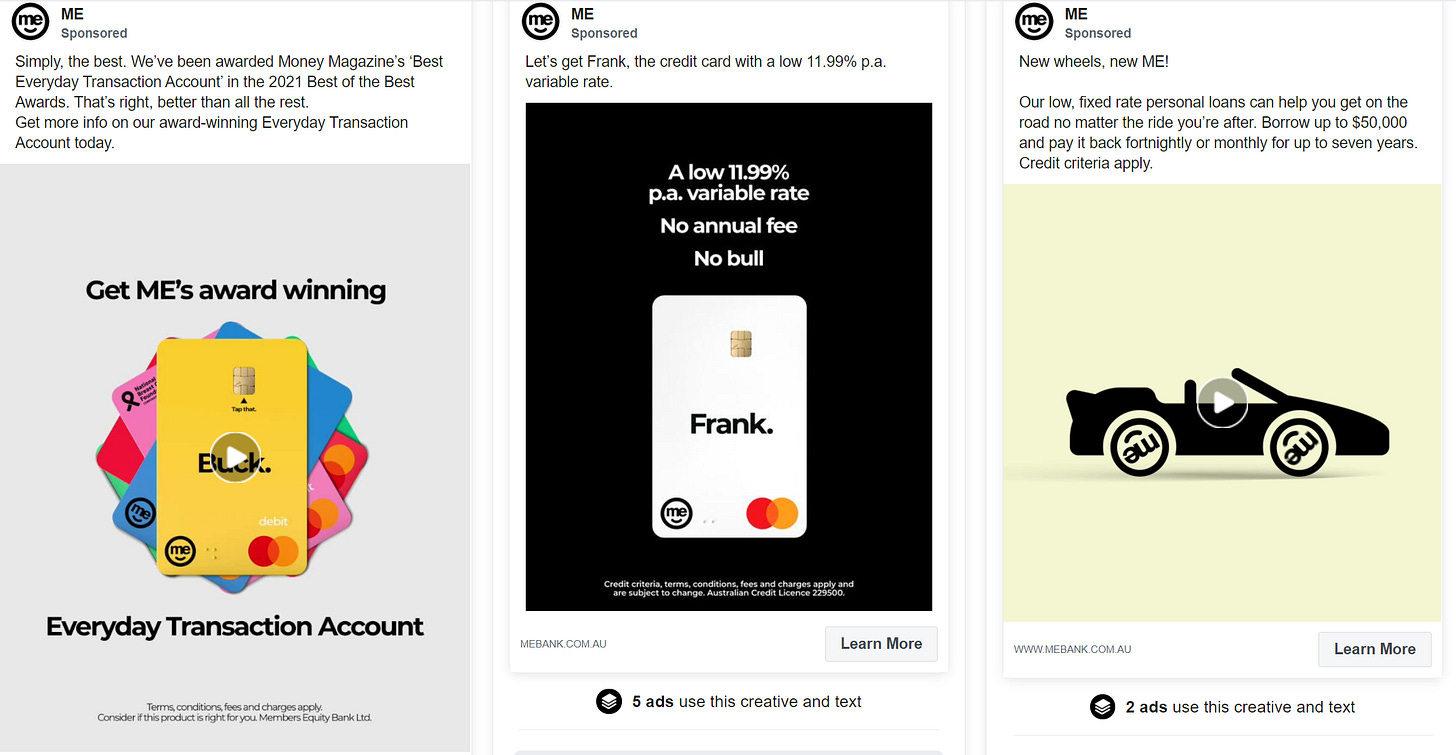

ME Bank, loved for being ethical, has a majority of their ads focused on reducing debt and their credit services, but they do also have an ad for their everyday account, and they’re using awards to sell it.

Interestingly, Westpac has a LOT of ads. Ads for insurance of every kind, ads promoting their community outreach, superannuation ads, their app, everyday savings accounts, and then there was this:

Punctuation with spaces either side aside, this co-branded MamaMia + The Glow podcast + Westpac ad stood out as very different to their other ads, and the “Yes, You Need Four Different Bank Accounts” was really what everyone was saying in the Up comments, but it seems snarky, so I’d be interested to know why they went with that tone.

Bank Australia really play on the ethical arguments in their ads, and to be honest, good on them.

LAST ONE! Bendigo Bank has a variety of ads, but I found these ones the most interesting to talk about. They’re really just like, here’s our interest rates, here’s our numbers, do you want it yes/no. Which, I am surprised that I didn’t find more ads like this, and considering the amount of people quoting Up having a good interest rate, I’m surprised I did not see more.

My conclusion

Why do people pick some neo banks over others? I think this quote from one of the comments truly sums it up:

Also their card is really pretty lol

It’s the branding. It’s the appeal to young people who do not know how to manage their money, or how to budget. *Insert monologue about financial literacy/personal finance not being taught in schools enough*

Up benefits from a lack of financial knowledge, which let’s be realistic, is a large percentage of the population. All the wealthy people (*that are not in the tech ecosystem) with Up accounts most likely just thought it was fun/a ‘pretty card lol’.

BONUS: WHO HAS THE BEST RETARGETING?

So since I looked up all their ads, I immediately got retargeting ads on Instagram literally minutes after writing this issue. In order of who retargeted me first: surprisingly Bendigo Bank, then Citibank (who I didn’t look up but go off with those behavious based targeting skills), St George (who I have a personal vendetta against), Point Hacks AU, and Sharesies AU - I don’t know if I want to even google what those last two do.

Thanks for sticking till the end - here’s the links

An article about localising websites (with examples!) and whether you should opt for the same UI with a straightforward translation, or different UI for different regions.

An interview with Jared Spool, one of the first ever UX researchers/designers.

An article from a marketing services provider that claims to have the FB ad performance benchmarks for different industries.

A nice campaign! Glossier is selling mascara with a big cinematic film vibe, and they’ve also been praised for using cinemas that are closed due to covid as billboards.